>> Bondsmojo <<

The Easy, Fast Way To

Invest In Bonds

- Trusted State Government

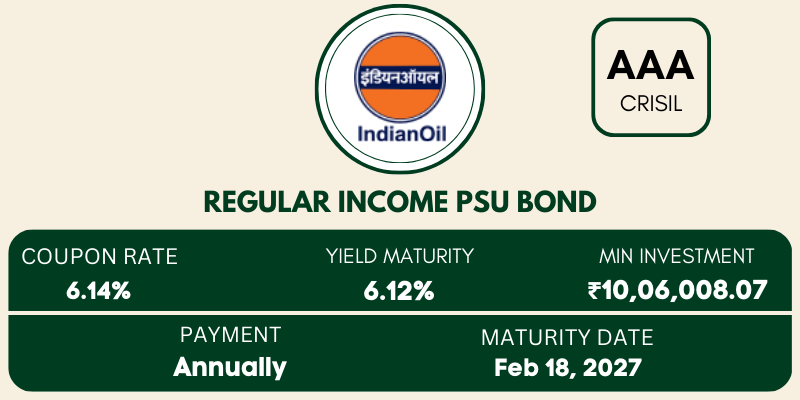

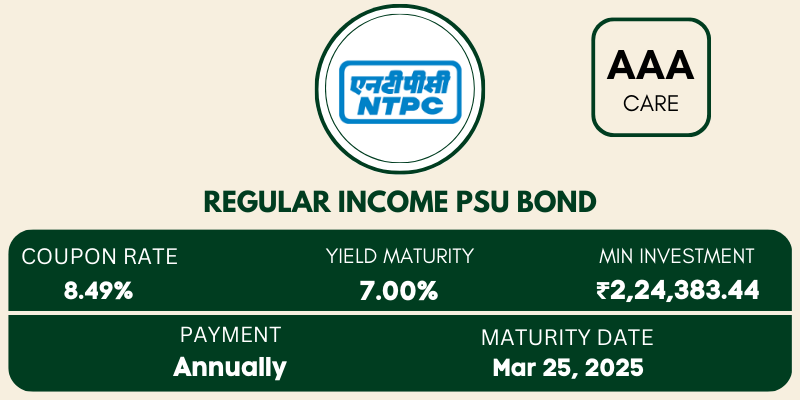

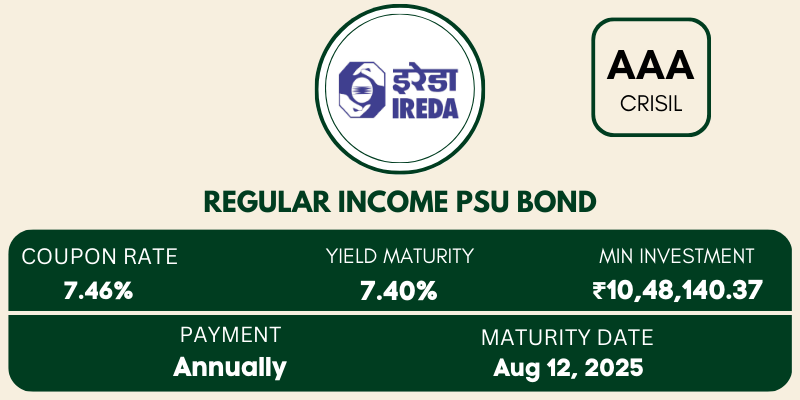

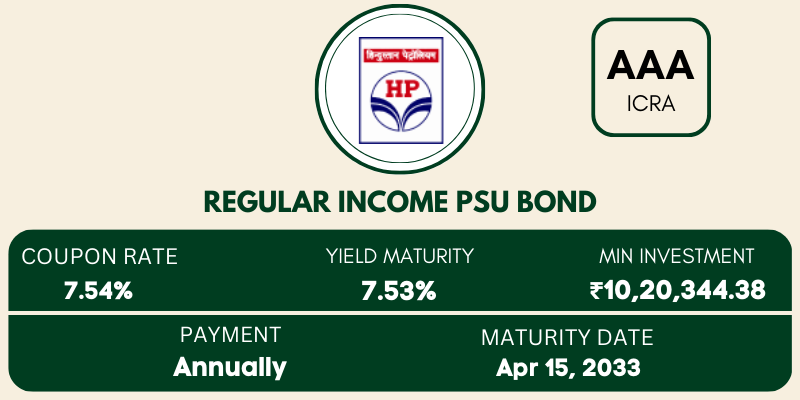

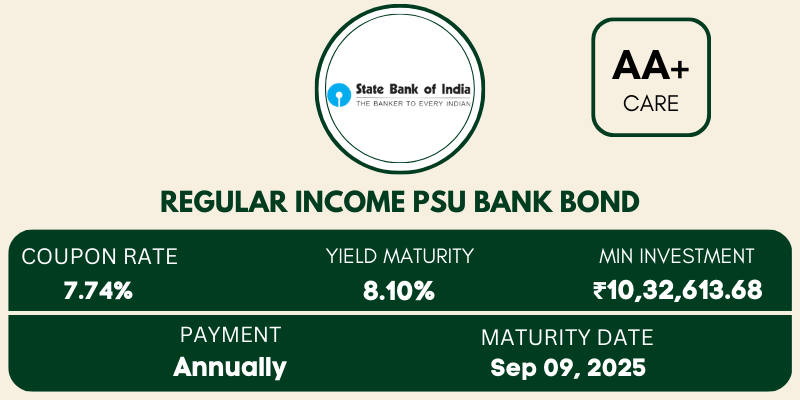

- Top Tier PSUs

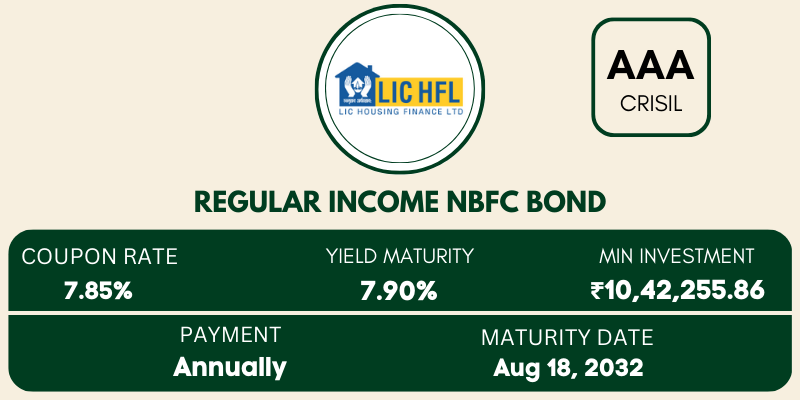

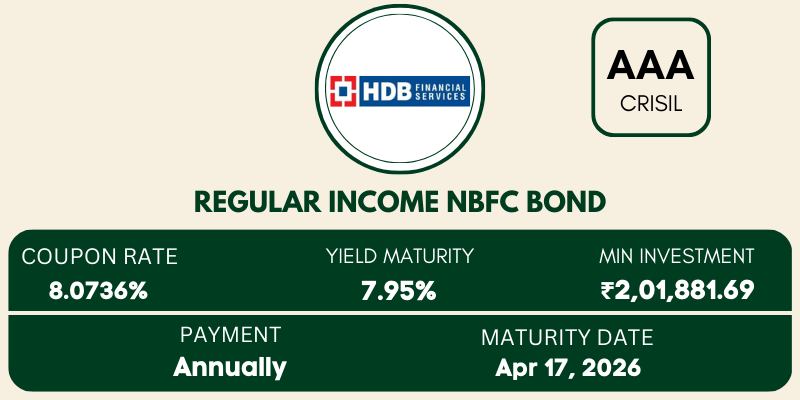

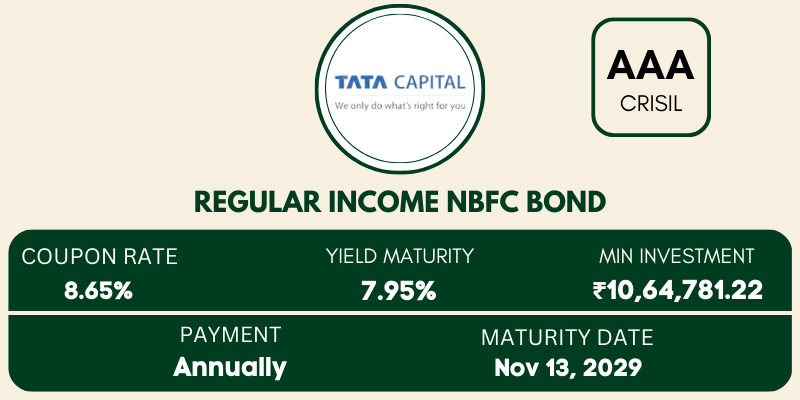

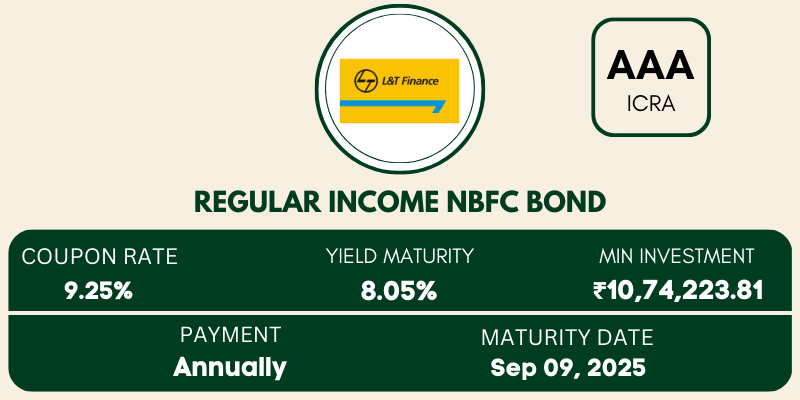

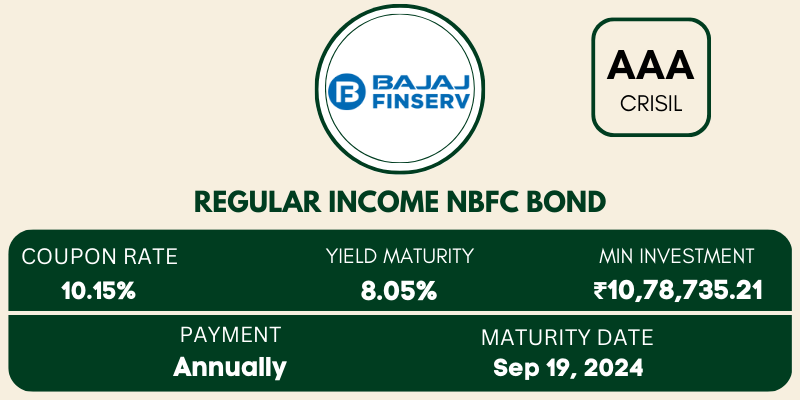

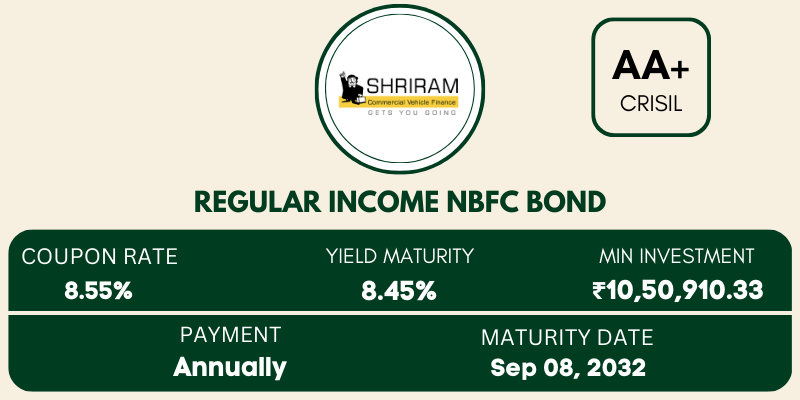

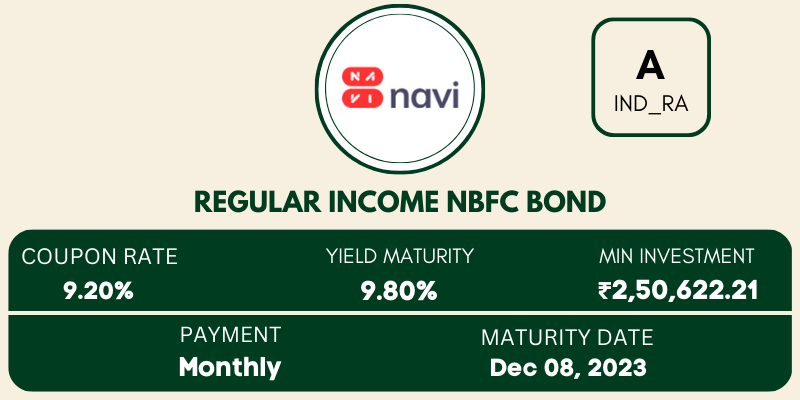

- Registered NBFCs

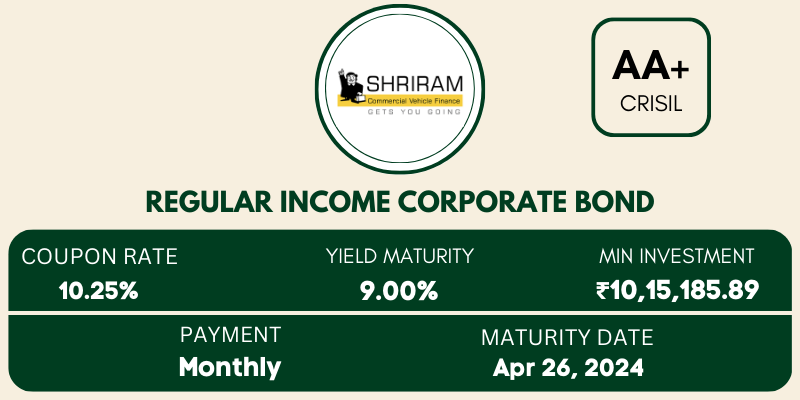

- Leading Corporates

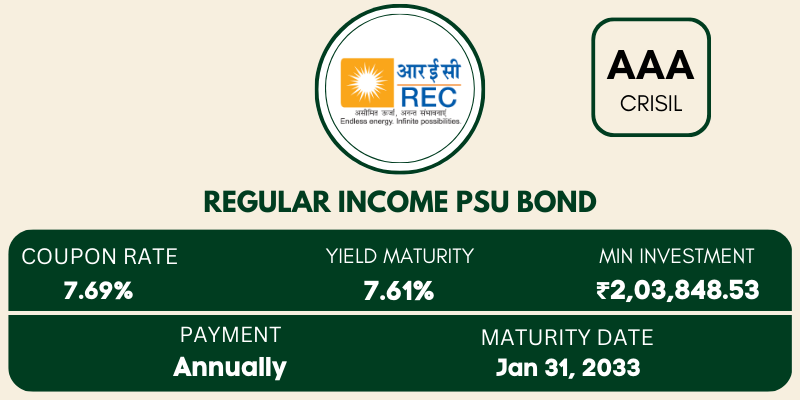

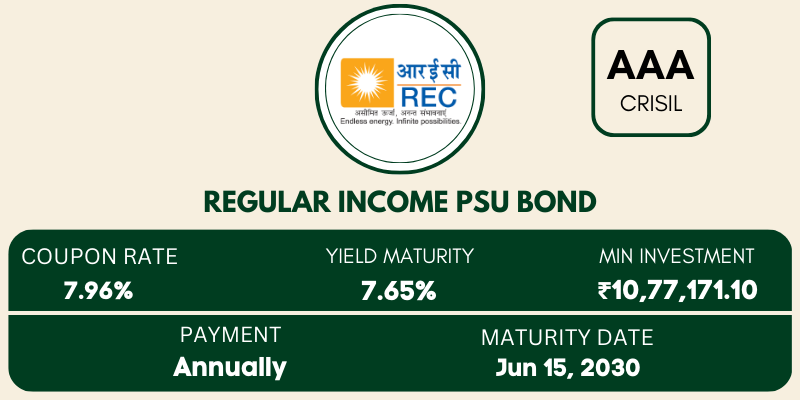

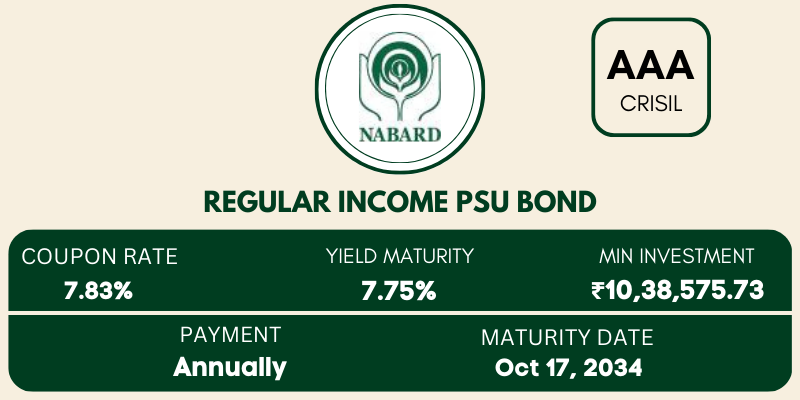

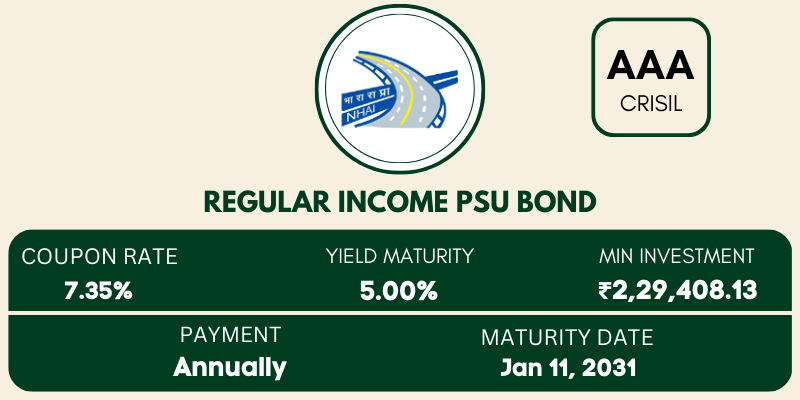

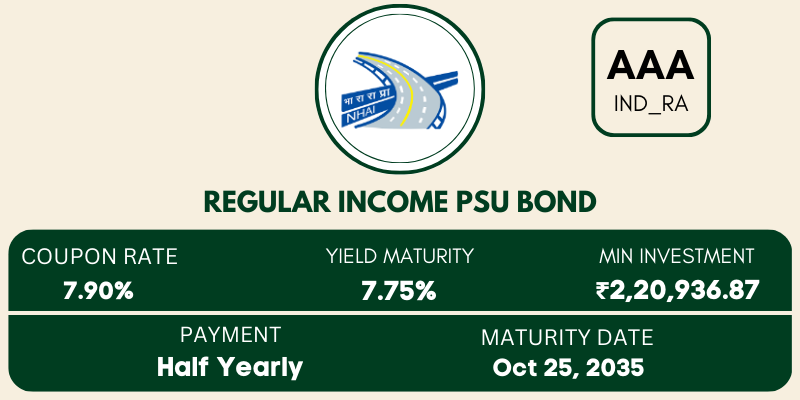

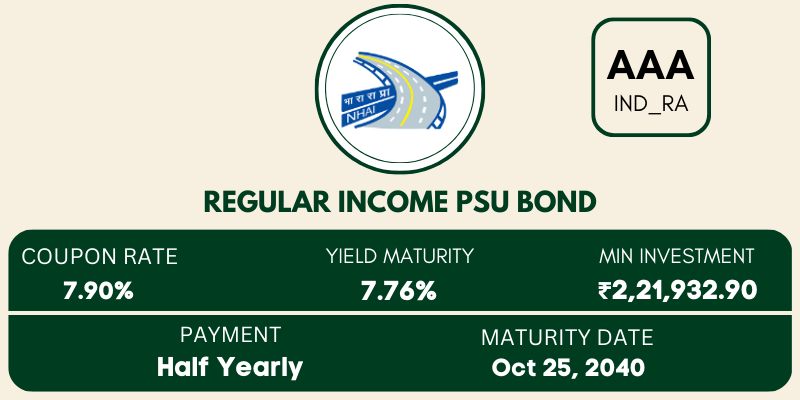

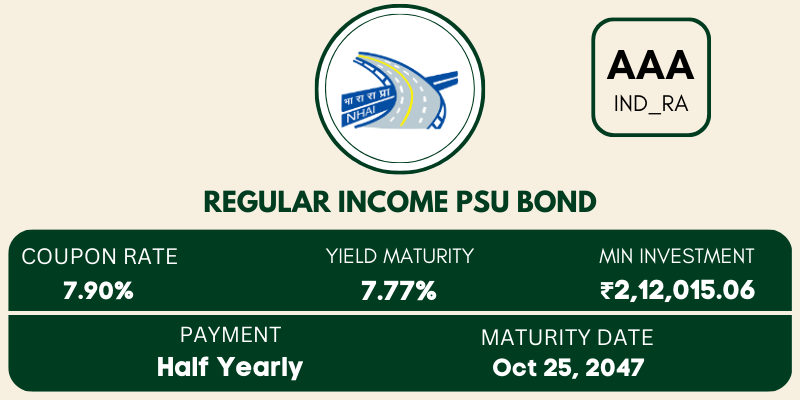

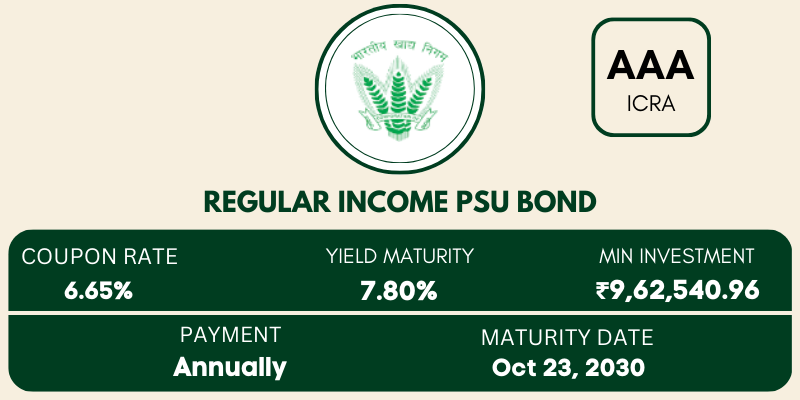

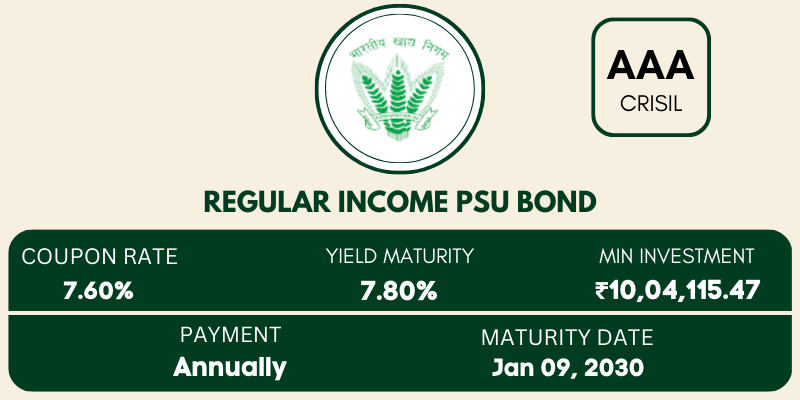

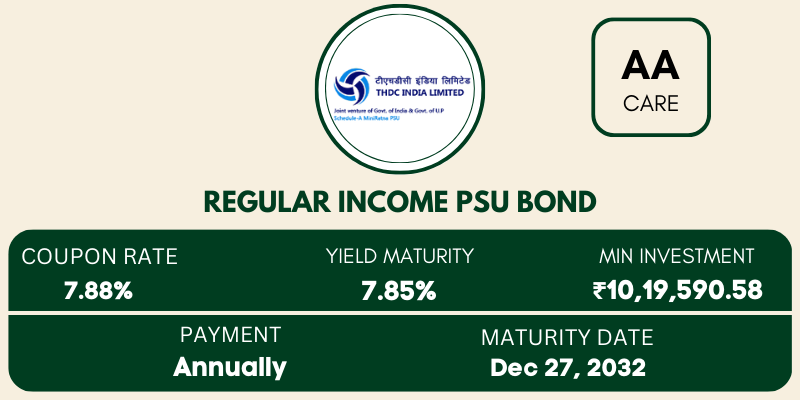

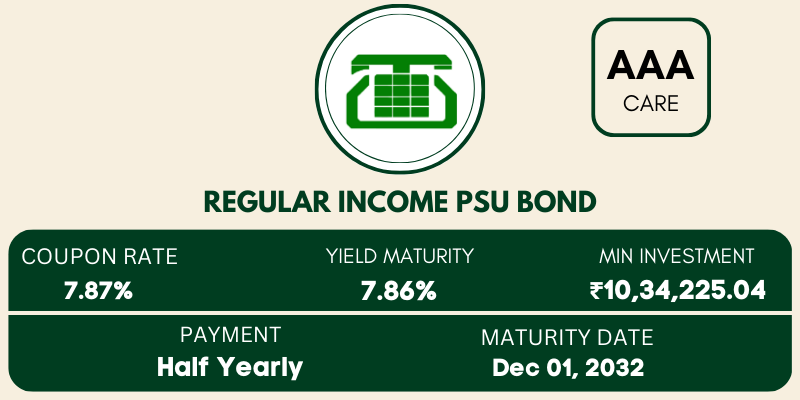

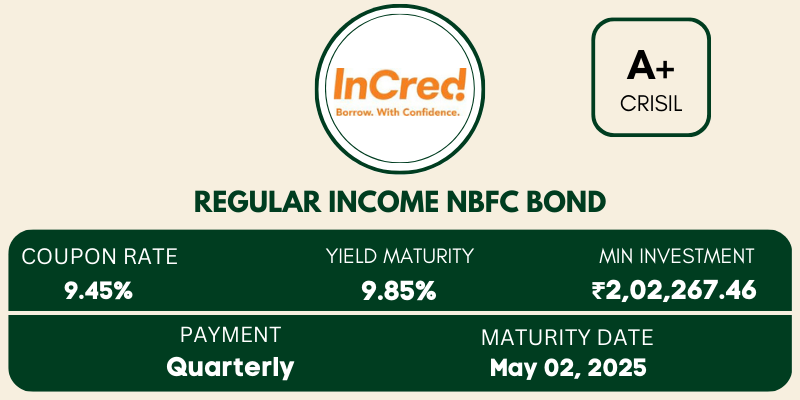

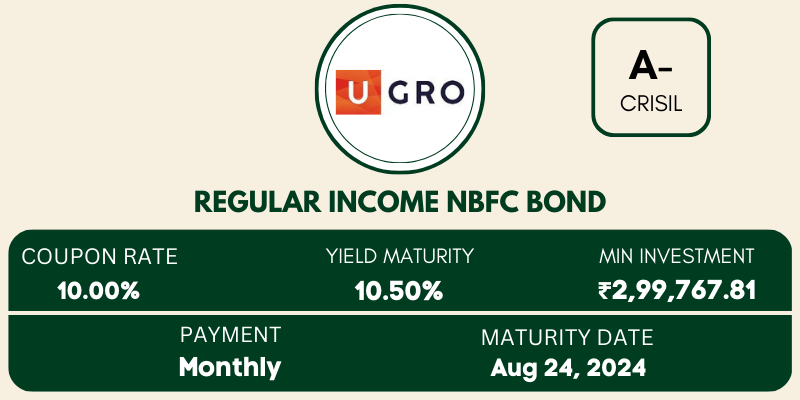

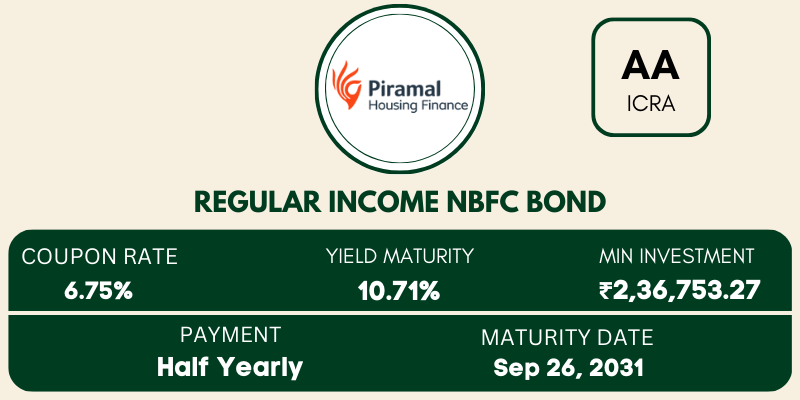

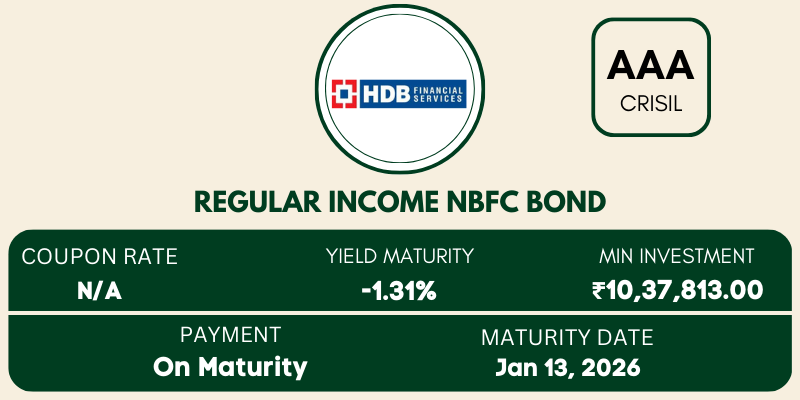

High Rated Secondary Bonds

Investing in secondary bonds in India offers higher returns than traditional savings accounts and fixed deposits, with lower risk and greater liquidity. It also provides a diverse range of investment options, making it a smart choice for those seeking stable returns.

>> Why Choose Us ? <<

Helps You Achieve

Diversity Portfolio With Fixed Incomes

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Fixed Returns as high as 12%

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Steady Risk With 5 Years Tenure

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Secured With Low Risk

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

>> Steps To Start <<

Get Started Now

Complete KYC

Upload your documents online to complete your KYC.

Shortlist & Choose Your Bond

Select bonds that match your investment goal.

Make Your Investment

Pay and receive bond units in your demat account.

>> For Quick Call <<

(+91) 99999 - 99999

support@bondsmojo.com

>> Frequently Asked Questions <<

Has Any Queries?

BondsMojo is the ultimate destination for investors looking to make well-informed decisions regarding Secondary Bonds. As a part of our exceptional services, we provide investors with accurate, data-driven insights through our cutting-edge in-house analytics platform, specifically tailored to cater to the needs of investors interested in Secondary Bonds. At BondsMojo, we ensure that all investment options related to Secondary Bonds are thoroughly examined, ensuring safety, premium quality, and meticulous vetting processes. Trust BondsMojo for secure and reliable Secondary Bond investments.

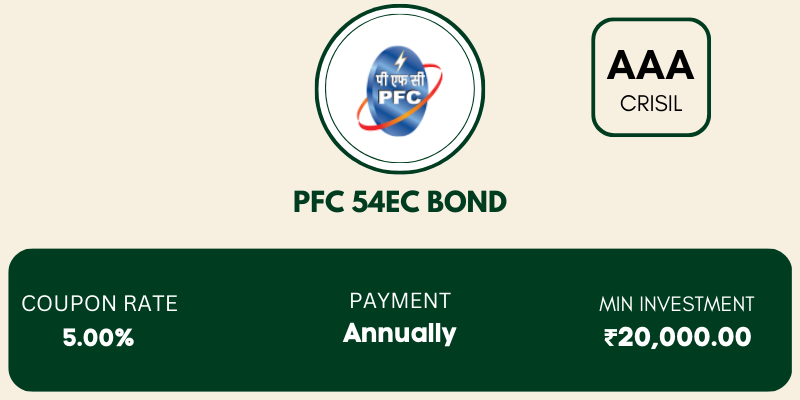

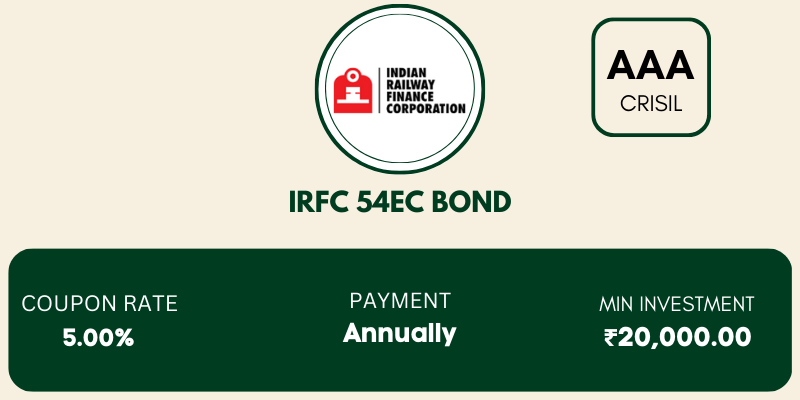

The Indian Market offers investors a diverse range of bond options, encompassing seven distinct types. These include Capital Gains Bonds, Government Securities, Corporate Bonds, Inflation-Linked Bonds, Convertible Bonds, Sovereign Gold Bonds, and RBI Bonds. Each of these bond types presents unique features and opportunities for investors to explore in the Indian Market.

Currently, we do not impose any minimum investment account requirements, giving investors the freedom to decide the amount they wish to invest based on their own discretion. We believe in providing flexibility and empowering investors to choose the investment size that aligns with their individual preferences and financial goals.

Corporate investors, similar to other investors, are required to complete the KYC (Know Your Customer) process when investing in bonds. The following documents are necessary for this due process:

- PAN Card of the Company

- Address proof of the Company

- Canceled cheque

- DP (Depository Participant) Client Master List (current date)

- Color photo of authorized representatives

- Board resolution with the Authorized Signatory List (on company letterhead) – attached format

- List of Directors with Director Identification Number (DIN) as of the current date (on company letterhead)

- Shareholding pattern as of the current date (on company letterhead)

- Memorandum of Articles

- PAN Card and Aadhaar Card of the Directors

- FATCA (Foreign Account Tax Compliance Act) – attached form

By providing these documents, corporate investors can successfully complete the KYC process and proceed with their bond investments.