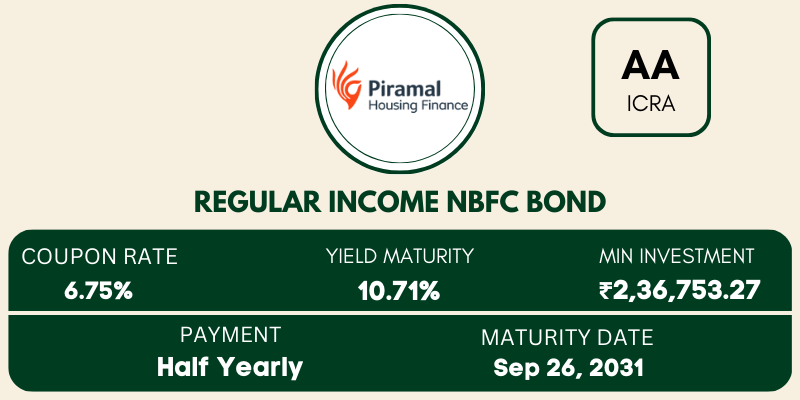

CREDIT RATING

AA

CASH FLOW

YOUR INVESTMENT OF

INTEREST EARNED

₹1,02,043.37

INTEREST EARNED

₹1,02,043.37

Disclaimer: The actual number can vary slightly based on actual Interest Payment date

SECURITY

This bond is SECURED

SENIORITY

In case of default, the bond holders will be considered ‘Senior’ for payment

LISTED

It got listed on exchange on Sep 29, 2021

About Issuer

Piramal Capital & Housing Finance

INDUSTRY

Financial Services

YEAR FOUNDED

N/A

HEAD OFFICE

Mumbai

TYPE OF ISSUER

Corporate

BUSINESS SECTOR

N/A

CURRENT MD/CEO

Khushru Jijina

OWNERSHIP

N/A

Issuer Highlights

- Piramal Capital & Housing Finance (PCHF), wholly owned subsidiary of Piramal Enterprises Limited (the flagship company of Piramal Group) is registered as a housing finance company with National Housing Bank (NHB)

- They provide both wholesale and retail funding opportunities across sectors.

- In real estate, they provide housing finance and other financing solutions across the entire capital stack ranging from early stage private equity, structured debt, senior secured debt, construction finance and flexi lease rental discounting.

- For the Hospitality sector, they provide financing solutions to hotels which will be operated by branded players in established and emerging markets.

- The wholesale business in the non-real estate sector includes separate verticals – Corporate Finance Group (CFG) and Emerging Corporate Lending (ECL).

- CFG provides customized funding solutions to companies across sectors such as infrastructure, renewable energy, roads, industrials, auto components etc. while ECL focuses on lending towards Small and Medium Enterprises (SMEs).

- As of 31 March 2021, Debt-Equity ratio was 1.39, Net worth was Rs.11,18,676 lakhs, Debt service coverage ratio is 0.15 and Interest service coverage ratio is 1.52

- The total income for the issuer for FY 2020-21 was Rs. 50,879 Cr. and total expenses were Rs. 35,477 Cr. resulting into a PAT of Rs. 10,344 Cr.

- The earning per equity share (basic and diluted; face value of 10) was 0.54 as of 31 March 2021 which is 27 times the earning per equity share of 0.02 as of 31 March 2020